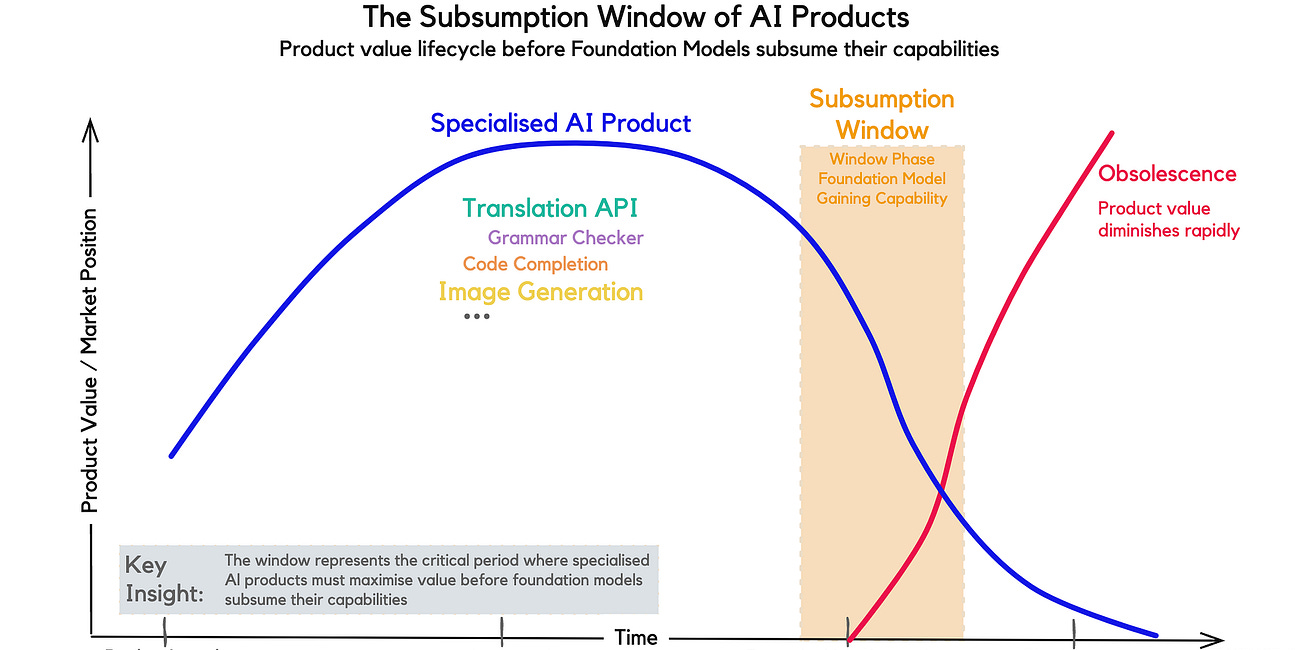

In my previous post, I introduced the concept of the Subsumption Window in AI — the fleeting period during which a specialised AI product delivers unique value before being rendered obsolete by advancements in foundation models that absorb its core functionalities.

As foundation models like GPT-4o (and now GPT-5) evolve at breakneck speed, this window is shrinking, forcing AI product teams to build defensible moats beyond mere model wrappers, such as proprietary data, seamless integrations and tailored user experiences.

Fast-forward to August 2025, and we have a textbook example unfolding in real time: Duolingo ($DUOL), the gamified language-learning app, experienced a dramatic stock rollercoaster tied directly to OpenAI’s GPT-5 reveal.

This event not only illustrates the subsumption window in action but also underscores the vulnerabilities of even established players in the AI ecosystem.

Earnings Highs Meet AI Disruption

Duolingo reported stellar Q2 2025 earnings on 6 August , showcasing robust growth fueled in part by its own AI integrations.

Revenue surged 41% year-over-year to $252.3 million, daily active users (DAUs) climbed 40% to 47.7 million, and paid subscribers grew 37%.

The company raised its full-year revenue guidance to over $1 billion, highlighting AI-driven efficiencies like personalised lesson generation and new features in chess and math courses.

But the celebration was short-lived.

On 7 August, OpenAI unveiled GPT-5, complete with a demo showcasing its ability to build a fully functional French-language learning app in just minutes — using natural voice interactions, adaptive tutoring, and code generation from a single prompt.

Testers described GPT-5 as a “coding genius” capable of creating complex projects like city simulators on the fly.

The demo echoed Duolingo’s core value proposition: accessible, interactive language education.

Almost immediately, Duolingo’s stock forfeited roughly half its gains, closing the day up only 13.75% at around $390.

The pain didn’t stop there.

By 8 August, shares dipped further amid broader market reactions to GPT-5’s implications, and the downward momentum continued.

How This Fits the Subsumption Window

Duolingo’s experience perfectly maps onto the subsumption window framework:

Initial Growth Phase (Product Lifecycle Curve)

Duolingo has thrived as a specialised AI product, leveraging machine learning for gamified, personalised language lessons.

Its moat includes a massive user base, proprietary learning data, and brand loyalty (who hasn’t seen the green owl memes?).

AI has been a boon, helping scale content and boost retention.

Foundation Model Advancement (Red Line)

GPT-5 represents the rapid encroachment of general-purpose models.

By incorporating multimodal capabilities — like voice, code generation and real-time adaptation — it can subsume narrow tools.

The French demo wasn’t hypothetical; it demonstrated how users could bypass apps like Duolingo for on-demand, hyper-personalised tutoring via simple prompts.

The Window Closes (Orange Overlap)

Duolingo is squarely in this critical period.

While it still offers value through structured curricula and community features, GPT-5’s accessibility threatens to make it obsolete for casual learners.

As one analyst noted, Duolingo’s own SEC filings warned of this risk: emerging tech could “rapidly scale and displace existing brands.” The stock drop reflects investor fears that the window is slamming shut faster than anticipated.

This mirrors past examples I discussed, like grammar checkers subsumed by GPT’s writing prowess or translation APIs overtaken by multilingual models. Language learning, once a defensible niche, is now low-hanging fruit for foundation models.

Implications and Strategies for Moat Resilience

Duolingo’s jolt serves as a wake-up call for AI product teams.

Skeptics argue it’s “the end” for Duolingo, but optimists point out its early access to LLMs and loyal user base mean it could integrate GPT-5 itself, turning threat into opportunity.

To extend their subsumption windows, companies like Duolingo should double down on:

Reassess Often

Track foundation model updates and pivot to unsolved problems, like combining AI with human tutors or AR/VR immersion.

In enterprise AI, this event highlights obsolescence risks and vendor lock-in concerns. Duolingo’s 10-K warning was prescient — companies must plan for disruption. The subsumption window isn’t just theoretical; it’s a market force reshaping valuations overnight.

As AI accelerates, the flashlight apps of today are the language learners of tomorrow. Build resilient moats, or risk being subsumed. What do you think — will Duolingo bounce back, or is this the start of a broader edtech shakeout? Share your thoughts below.

Chief Evangelist @ Kore.ai | I’m passionate about exploring the intersection of AI and language. Language Models, AI Agents, Agentic Apps, Dev Frameworks & Data-Driven Tools shaping tomorrow.

The Subsumption Window of AI

Thanks for reading Cobus Greyling on LLMs, NLU, NLP, chatbots & voicebots! Subscribe for free to receive new posts and support my work.